👀 最近Zoocasa发布了一份对比报告,把过去35年30多岁的加拿大人买首套房的难度做了个横向PK,结果真是让人五味杂陈。

.

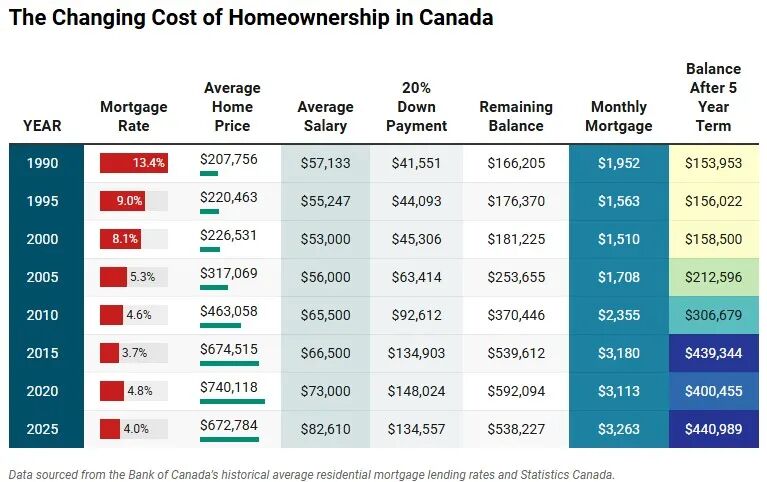

📊 来看几个关键数据:

1990年:

房价 $207,756

首付 $41,551(攒10年能搞定)

利率高达 13.4% 😱

月供 $1,952,占家庭收入41%

2025年:

房价 $672,784

首付 $134,556(要攒22年…😭)

利率只有 4.04%

月供却飙到 $3,263,占收入47%

👉 结论是:利率虽然低了,但房价涨得更快,年轻人买房的负担比父母辈还重!

.

代际对比 🏡

👴 婴儿潮一代:利率高,但房价低 → 一降息就财富暴涨。

👨🦳 X世代:赶上了利率下降的红利 → 相对轻松上车。

🧑 千禧世代 & Z世代:买房周期更长,攒首付要20年以上,还贷压力更大 → 房子越来越像“奢侈品”。

.

💡 Zoocasa的结论很扎心:

单看利率没用,收入增长追不上房价,才是最大问题。

买房不只是“现在要不要上车”,还关乎财富积累、退休计划和代际传承。

.

来聊聊🔥

特别想听听大家的想法:如果让你在 1990年高利率+低房价 和 2025年低利率+高房价 中二选一,你会选哪一个?

.

信息来源:Zoocasa《加拿大购房难度35年对比报告》

Comments:

Post Your Comment: